Crypto

The Dark Side of Crypto: What Meme Coins Teach Us About Human Behavior

The world of cryptocurrencies has transformed the way people perceive money, investments, and even personal freedom. It offers innovation, financial independence, and decentralization. However, a darker story lies beneath this shiny exterior, revealing a great deal about human nature. In the rise of joke coins like Dogecoin, Shiba Inu, and more recently PEPE and Turbo, this is most clear. Creators often make these coins as a joke at first, but they quickly attract a lot of attention in the crypto market and can become worth billions of dollars.

Why do people spend money on things that don’t work or have a basis in reality? Why do scams happen so often, and why do people keep falling for the same tricks? The answer has nothing to do with market trends or crypto technology. It has to do with psychology, feelings, and our basic needs to belong, be safe, and earn a living. This blog post will talk about how meme coins show the bad side of crypto and what they say about how people act, make decisions, and the emotional traps of financial hype.

The Allure of Hype and Quick Riches

The ease with which talk drives value is one of the most intriguing aspects of meme coins. Promoters often use viral memes, endorsements from famous individuals, and social media trends to promote memecoins. People buy in because they don’t want to miss out (FOMO), not because the fundamentals are good. People tend to act in ways that are focused on getting rewards in the speculative crypto market. The idea of getting rich quickly speaks to a basic need for success that doesn’t require any work.

They disregard the red flags and poor tokenomics and jump right into the crowd. Most traditional investments take time and study. Meme coins, on the other hand, promise an emotional roller coaster along with the illusion of easy money. This illustrates how quickly emotion can override reasoning when the promise of quick money is present. The ups and downs of these coins indicate that many people are following their dreams rather than making plans.

Herd Mentality and the Need to Belong

People are social creatures, and our need to fit in often takes precedence over what makes sense. People in the world of cryptocurrencies often display this type of behavior, which reflects a “herd mentality.” A lot of people become interested in a coin when it becomes popular on Reddit, X (Twitter), or TikTok. Many people join projects simply because “everyone else is doing it.” This is similar to the standard psychological pattern observed in groupthink, where the group’s excitement overrides individuals’ thoughts.

This works out well for memecoins. It appears that they’re more serious the more people join. The community is a significant selling point, even if the project itself doesn’t offer anything particularly useful. Meme coins teach us that many buyers aren’t just looking to make money; they’re also looking for a sense of belonging, to be a part of something new and exciting, even if it’s just a shell.

Greed Overcomes Caution

In the world of crypto, greed is one of the most powerful forces, and meme coins take full advantage of this. When people buy meme coins, they usually do so with the goal of “10x” or “100x” their investment in a few days or weeks. People often forget basic safety rules because they prioritize making a lot of money. They don’t read white papers, look for risks of rug-pull, or even know how the token works. People don’t need to be careful as long as prices are going up.

This practice is more like an addiction to gambling than a way to make money. Speculating on meme coins is more like playing slots than investing real money. A chance to win big, no matter how small, is enough to get a lot of people interested. This reveals a crucial truth: many people are not investing; they are gambling. For this reason, they leave themselves open to loss, scams, and mental destruction when the bubble pops.

Scams, Manipulation, and False Hope

The market for meme coins is a prime target for con artists and scammers seeking to profit. As new coins come out, they are often not meant to be part of a long-term project. Instead, they are “pump-and-dump” schemes designed to enrich insiders while draining the funds of ordinary users. Projects or developers often pay influencers to spread the word about these coins, which drives up the price before early users sell off and cause the value to drop. What works about these scams is not how complicated they are but how easily they can befall the unwary.

They inspire people to trust, hope, and care for one another. Investing is easy when people are sure they’ve found the next big thing. The sad truth is that many people lose money not because they made mistakes but because they made decisions based on their emotions. Memecoins demonstrate how easily people can be tricked when they are hopeful rather than skeptical. It’s a tough lesson, but it highlights the importance of understanding money and managing your emotions in the cryptocurrency space.

Conclusion

Cryptocurrency is still relatively new and is evolving rapidly. It opens up numerous possibilities for new ideas and progress, but it also reveals some uncomfortable truths about human behavior. In particular, meme coins aren’t just internet jokes; they’re like screens that show our fears, wants, and bad choices. They teach us that hype can be more important than reason, that people want to fit in, that greed can make us not be careful, and that fake hope can cause us to lose things we want.

To get around in this wild financial realm, you need to know about the bad side of crypto. We must be aware of the psychological forces at play if we want to create a more equitable, resilient, and trustworthy future for digital banking. To survive and thrive in this place, you will need to be educated, aware, and able to control your emotions. Memecoins may go away, but the lessons they teach last a long time. They should teach us something so that history doesn’t repeat itself over and over again.

Business

Ethereum in 2026: Can You Still Mine It or Not?

Ethereum has been one of the most influential cryptocurrencies since its launch in 2015. It gained immense popularity among developers and investors due to its smart contracts and decentralized applications. On the other hand, Ethereum has undergone significant changes over the years. With Ethereum 2.0, one of the most significant changes was the transition from Proof of Work (PoW) to Proof of Stake (PoS). The goal of this change was to make the network more scalable and use less energy.

Now that it’s 2026, many people want to know: Can you still mine Ethereum? The answer may not be as clear now that the Ethereum blockchain no longer relies on standard mining. This blog will discuss the current state of Ethereum, the impact of the switch to staking, and what options are available to those who previously mined ETH. Here is everything you need to know about Ethereum in the year 2026, including whether mining is still an important part of its environment.

The End of Proof of Work for Ethereum

With an update called “The Merge” in September 2022, Ethereum’s mining process came to an end. Proof of Work (PoW) was replaced by Proof of Stake (PoS) with this significant change. Miners used very fast computers to figure out hard problems and get rewards in the PoW model. PoW, on the other hand, consumed a significant amount of energy and generated environmental problems. That’s why the people who work on Ethereum switched.

Ethereum no longer needs miners because of PoS. Instead, validators risk ETH to keep the network safe. Randomly selecting these validators to verify deals and add new blocks is how they perform their job. As a result, GPUs and ASICs, which were once used for mining, are no longer suitable for Ethereum. Now that it’s 2026, the answer is clear: you can’t mine Ethereum the old way anymore.

Ethereum Staking: The New Way to Earn ETH

Although you can no longer mine Ethereum, you can still stake to support the network. This is what Proof of Stake is all about. You need to deposit 32 ETH to become a validator. You can earn reward points for verifying deals. This method is easier to access and uses less energy than mining.

Don’t worry if you don’t have 32 ETH. You may join a pool for stakes. With these pools, money from multiple users is combined to reach the required amount. Then, the prizes are divided based on the amount each person contributed. As of 2026, staking is the standard way to help the Ethereum network and make money without doing anything. Mining is over, and holding is the new thing to do. For the blockchain’s long-term health, it’s also safer and more flexible.

What Happened to Ethereum Miners?

Miners had to decide what to do after Ethereum moved to Proof of Stake. Their pricey mining gear was no longer useful for Ethereum. Other miners transitioned to mining other cryptocurrencies, such as Ergo (ERG), Ravencoin (RVN), or Ethereum Classic (ETC). Some miners sold their hardware. Proof of Work is still used for these coins, and GPU mining is still possible. However, these options don’t generate as much revenue or remain as stable as Ethereum has.

Many miners lost money because the rewards were low and the cost of power was high. Others utilized their powerful GPUs to expand into new areas, such as cloud computing or AI processing. In 2026, most people who previously mined Ethereum have either transitioned to other jobs or ceased working in the field altogether. The end of ETH mining marked the end of a chapter, but it also prompted people to think of new ways to utilize their hardware and skills.

Can You Still Mine Any Form of Ethereum in 2026?

Forks and other networks, like Ethereum, that use Proof of Work are still in existence in 2026, but Ethereum itself can’t be mined. One example is Ethereum Classic (ETC), which is the first form of Ethereum before it split in two in 2016. Mining is still possible on Ethereum, and its community is very loyal. You could also try alternatives like “ETHPoW,” a fork that kept the PoW model after the Merge.

However, these networks are typically smaller and generate less revenue. Not as many people want them, and they’re not worth as much as ETH. To ensure that mining them is worth the cost of energy and hardware upkeep, you need to perform extensive calculations. In short, you can no longer mine the main Ethereum (ETH) system. You can only mine coins that resemble Ethereum or originate from it. Before you put your time or money into a mining project in 2026, you should know the difference.

Should You Invest in Ethereum in 2026?

In 2026, Ethereum remains a viable investment option, despite the fact that mining is no longer feasible. Many autonomous apps, NFTs, and smart contracts run on it. In the world of DeFi (Decentralized Finance), Ethereum is also the leader. The network functions more efficiently now that Proof of Stake is in use, and gas fees have decreased. This makes it easier to get more people and developers.

Staking is a new way to get benefits, and Ethereum is always adding new features. ETH investors can generate profits from network growth, staking, and the coin’s value appreciation over time. If you don’t want to stake directly, you can use ETFs or crypto sites that offer staking services with fewer restrictions. So, Ethereum is still a useful asset even if you don’t mine it. It remains the leader in crypto, boasting strong growth and practical applications in the real world.

Conclusion

Since the early days of mining and the Proof-of-Work consensus system, Ethereum has come a long way. The network has entered a new era with the successful launch of Ethereum 2.0 and its transition to Proof of Stake. In 2026, you won’t be able to mine Ethereum the way you used to. Powerful tools once solved puzzles, but that process is no longer used. But that doesn’t make Ethereum less interesting.

It is bigger, faster, and uses less energy now than it did before. Staking has replaced mining, giving users new ways to earn benefits and support the network’s operation. “Can you still mine Ethereum in 2026?” This is the question that people ask. The answer is no, at least not the Ethereum that most people are familiar with. You can still have a say in its future, though, by buying or staking. Ethereum remains the leader in cryptocurrency, and its evolution has paved the way for other blockchains to follow suit in the years to come.

Business

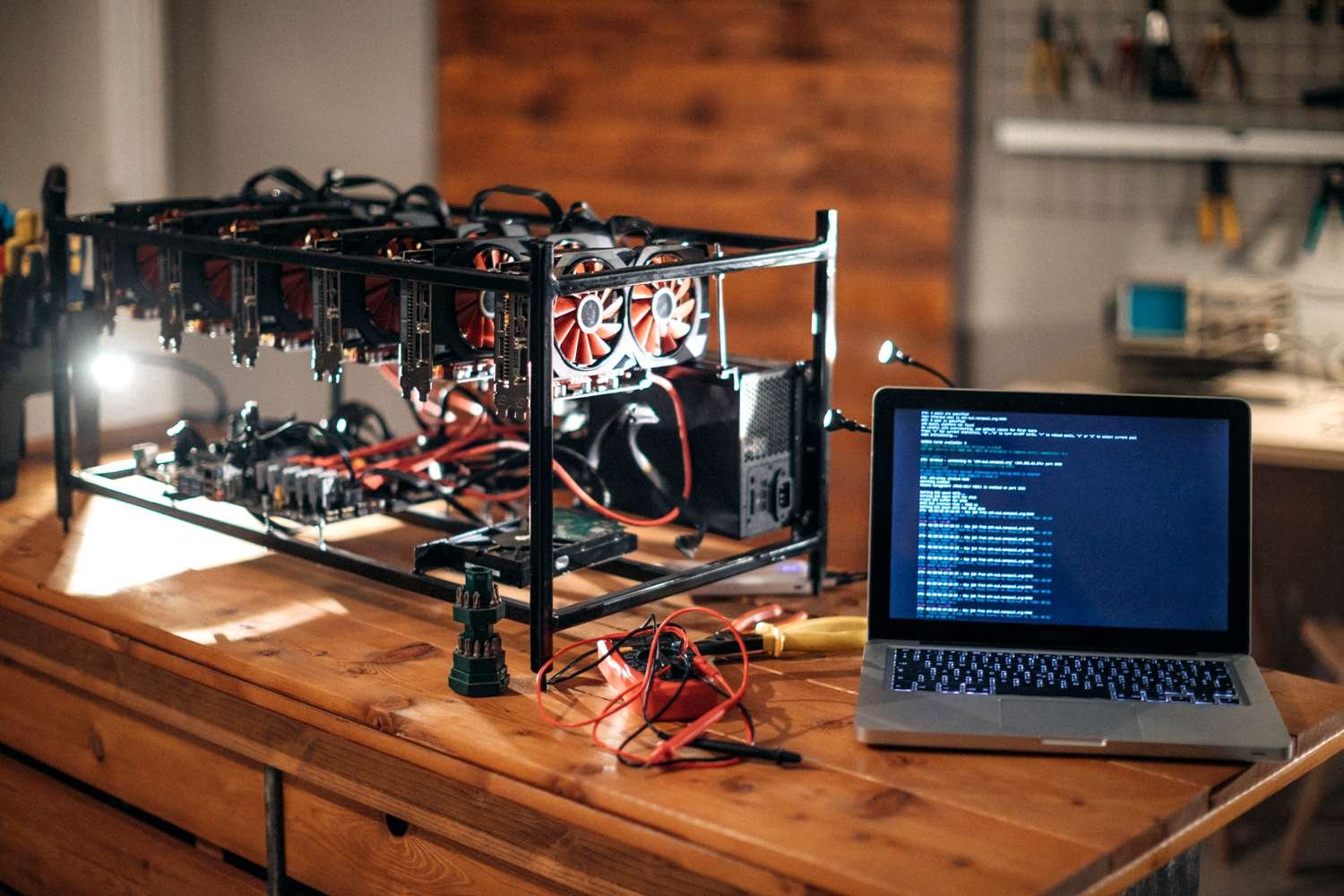

Crypto Mining Explained: Is It Still Worth It in 2025?

A lot has changed in the world of cryptocurrencies since 2025. In the past, crypto mining was seen as a gold rush for tech-savvy buyers. However, things have changed significantly in the last few years. Many people are wondering if crypto mining remains worthwhile in 2025, given the rising cost of energy, stricter regulations, and the growing popularity of proof-of-stake systems.

This blog will explain what cryptocurrency mining is, how it has evolved, and whether it remains a viable means of earning money today.

We’ll discuss the pros and cons, costs, and dangers that miners face. We’ll also discuss how new coins and tools are transforming the mining world. This article provides a clear account of the current state of mining, whether you’re a beginner looking to learn more or an experienced investor seeking to stay up to date. Let’s examine what crypto mining is really like in 2025 and determine if it’s still a viable option or a thing of the past.

What Is Crypto Mining and How Does It Work?

Crypto mining verifies that transactions in cryptocurrencies on a blockchain network are genuine. Miners use extremely powerful computers to solve complex mathematical tasks. By adding transactions to the blockchain, these systems confirm and protect them. Miners receive payment in cryptocurrency, typically in the form of the coin whose validity they helped establish. Proof-of-work (PoW) networks, such as Bitcoin, remain the primary location for mining in 2025. Ethereum, on the other hand, has transitioned to proof-of-stake (PoS), which alters the process of verifying transactions.

For Proof of Work (PoW) mining to work, you need special tools and a lot of power. How well mining goes depends on the availability of processing power, the cost of electricity, and the difficulty of the mining. Understanding the technical aspects of mining helps buyers determine if it’s a good investment opportunity. Mining has become increasingly competitive as concerns about the environment have grown, necessitating the need for more powerful equipment. Still, mining can be a good way to make money if you have the right equipment and the cost of electricity is low. This is especially true in places where energy is cheap.

The Rising Cost of Mining Equipment and Power

In 2025, the high cost of power and tools is a primary concern for miners. ASIC (Application-Specific Integrated Circuit) machines are expensive and require frequent updates to stay competitive. They are made to mine efficiently. A top-of-the-line ASIC miner can be expensive and will likely become outdated in a few years. Electricity remains the largest fixed cost. Mining rigs consume a substantial amount of power and remain in constant operation. When power costs a lot, businesses quickly lose money.

Some mines are moving to places like Iceland or parts of South America where energy is cheaper and cleaner. Some governments are also raising taxes or making it more difficult for large mining companies to obtain power. It costs more and makes things less certain. Breaking even can take months or even years if miners cannot obtain affordable hardware and energy. This makes it a dangerous investment for people who only mine occasionally.

Shift Toward Sustainable and Green Mining

As the world’s focus shifts to sustainability, cryptocurrency mining is being encouraged to have a reduced environmental impact. Many projects are moving toward more efficient ways of doing things in 2025. Renewable energy sources, such as wind, sun, and water, are being increasingly used to power mine farms. Over time, these methods not only cut costs but also make people less critical of crypto’s carbon footprint. Green mining is now more necessary than it was a trend.

Green mines have found it easier to operate in places like Canada and Norway, which offer tax incentives and access to cleaner energy sources. Some companies even advertise themselves as eco-friendly mines to attract investors. There are also improvements in chip efficiency and cooling systems that help reduce energy use overall. Making the switch to green mining requires an initial investment, but it helps ensure long-term sustainability and aligns with environmental goals. When rules become stricter, miners who fail to adapt may be forced out of the market.

Proof of Stake vs. Proof of Work: The Big Debate

This marks a significant shift in the world of cryptocurrencies in 2025: the ongoing debate between proof-of-stake (PoS) and proof-of-work (PoW) systems. Bitcoin utilizes the Proof of Work algorithm, which requires miners to solve complex puzzles to verify transactions. PoS, on the other hand, lets people back up deals with the coins they own and are willing to “stake.” Since Ethereum transitioned to Proof of Stake, many new coins have followed suit. PoS is thought to be more flexible and uses less energy. Because of this change, many coins don’t need to be mined in the usual way as often.

However, Bitcoin, the most popular cryptocurrency, still employs PoW, which means that mining remains important. Potential workers should be aware of this change. As more coins switch to PoS, there are fewer chances to make money by mining PoW coins. Newbies must decide whether to mine Proof-of-Work (PoW) coins, stake Proof-of-Stake (PoS) coins, or spend in other ways related to cryptocurrencies, such as yield farming or node operation. What you should do depends on your budget, goals, and technical skills.

Is Mining Still Profitable in 2025?

Do people still want to mine in 2025? That’s the big question. It’s not easy to say. Mining isn’t as appealing as it once was for casual individuals who lack substantial resources. Small or negative returns can occur due to factors such as high start-up costs, power bills, and market volatility. Some small mines might lose all their money. However, mining is still profitable for larger businesses that have access to cheap power and the latest tools. Industrial mining farms continue to generate revenue, particularly since the price of cryptocurrencies like Bitcoin remains high.

Mining pools also lower risk by allowing individuals to collaborate and share the benefits. Now, planning and scale are more important than ever in mining. No longer is it enough to just plug in a machine and wait for the money to come in. To successfully pursue mining in 2025, you should conduct extensive research. Consider all the risks and associated costs. Many people may achieve better returns with less effort if they stake or trade directly in coins.

Conclusion

Crypto mining isn’t the same as it used to be in 2025. The field has evolved, now shaped by stricter regulations, environmental concerns, and increased business costs. Mining is still mostly about validating deals in exchange for rewards, but the game is now much more difficult and competitive. In the right situations, mining can still be a viable way to generate income. To be successful now, you need to have access to affordable, renewable energy, high-tech mining equipment, and a deep understanding of the market.

It’s possible that mining may no longer be the best way for new crypto enthusiasts to get started. Other options, such as investing, staking, or participating in decentralized finance (DeFi), may yield better results with lower risk. To sum up, cryptocurrency mining is still thriving, but it’s no longer the easy money machine it once was. Carefully consider your goals, resources, and risk tolerance before making a decision. In 2025, mining will pay off for people who work smart, not just hard.

Business

How to Buy Trump Coin in 2025: Step-by-Step Guide + Price Prediction Insights

As the Trump Coin becomes more popular in 2025, cryptocurrency enthusiasts and buyers of political tokens are becoming increasingly interested in how to acquire it. No matter how experienced or new you are as a trader, you must understand how to buy Trump Coin and predict its price to make smart choices. Over the years, interest in the Trump Coin, a meme or utility token inspired by political events, has fluctuated. Many people are looking for the best ways to invest because the 2024 U.S. elections will likely affect how the market behaves.

This guide shows you how to buy Trump Coin step by step and gives you advice from experts on how much it might be worth in the future. We’ll also look at official Trump Coin price prediction studies from market experts to help you figure out if it will be successful in the long run. This guide will give you a clear idea of how to invest in Trump Coin and keep you updated on its expected performance.

Understanding Trump Coin and Its Market Position

It’s important to know what a Trump Coin is and what it does in the coin market before you look into how to buy one. The Trump Coin is a cryptocurrency linked to political sentiments, particularly those stirred up by Donald Trump’s public appearances and election cycles. Its value may change in 2025, depending on developments in politics, the media’s coverage, and investment speculation. This makes it challenging to predict the price of the Trump Coin, but it is also interesting for buyers. To determine if something is genuine, examining its history, usefulness (if any), and community support can be helpful. To avoid scams, always verify the token’s smart contract and official outlets before investing.

Step-by-Step Guide on How to Buy Trump Coin

To purchase a Trump Coin in 2025, follow these steps.

- Choose a Crypto Wallet: Opt for a secure wallet, such as MetaMask or Trust Wallet.

- Select an Exchange: Trump Coin may be available on decentralized exchanges (DEXs) like Uniswap or centralized platforms.

- Fund Your Wallet: Deposit Ethereum (ETH) or other supported cryptocurrencies.

- Swap for Trump Coin: Connect your wallet to the exchange, enter the token’s contract address, and confirm the swap.

- Secure Your Investment: Transfer tokens to a private wallet for safety.

Staying informed about official news on Trump Coin price predictions can help you plan when to make a purchase.

Analyzing Trump Coin Price Prediction for 2025

The price of the Trump Coin is predicted by experts who look at past data, market trends, and political factors. In 2025, its value could increase if politics gain momentum or decrease if people lose interest. Some analysts suggest that short-term gains may stem from the excitement following the election, while long-term stability hinges on the degree of acceptance of the idea. You can learn more by looking at official Trump Coin price prediction models made by crypto research companies. Meme coins are often affected by viral moves on social media, so investors should also keep an eye on those. Spreading out your trades and setting stop-loss limits can help mitigate the risks associated with its volatility.

Risks and Tips for Investing in Trump Coin

Before you learn how to buy Trump Coin, you need to know what the risks are. Political tokens are risky, and events in other countries have a big effect on their prices. Scams and “pump-and-dump” schemes are popular, so check the sources before you put money into something.

To minimize risks:

- Invest only what you can afford to lose.

- Track Trump Coin price prediction updates from trusted analysts.

- Avoid FOMO (fear of missing out) and make rational decisions.

People who plan to keep Trump Coin for a long time should decide if it has real uses or is just a speculative object. Keeping up with the news helps you make better business decisions.

Conclusion

It takes study and care to navigate the world of political cryptocurrencies, such as the Trump Coin. This guide shows you how to buy a Trump Coin in 2025, from picking out a wallet to making a safe exchange. Examining Trump Coin price prediction trends can also help you anticipate how the market will move. Even though the future of the token is still unknown, you can plan your move by keeping up with official Trump Coin price prediction studies.

Always put safety and research first when buying, whether you’re looking for short-term gains or long-term potential. The Trump Coin has risks, just like any other cryptocurrency, but making smart choices can help you make the most of your chances. Keep an eye on what’s going on in politics and the market to stay ahead. Get ready to invest? As you trade, remember the steps you were given and keep an eye on how the market changes. In 2025, Trump Coin’s path could be unexpected, but if you take the right steps, you can get through it. Have fun buying!

-

Crypto9 months ago

Crypto9 months agoTop Altcoins Outperforming Bitcoin in 2025

-

Business9 months ago

Business9 months agoDiscussing How Climate Change Is Influencing Men’s Fashion

-

Business8 months ago

Business8 months agoHow to Buy Trump Coin in 2025: Step-by-Step Guide + Price Prediction Insights

-

Fashion1 year ago

Fashion1 year agoThe Ultimate Guide to Fall 2024 Fashion Trends You Can’t Miss!

-

Business1 year ago

Business1 year agoBest SEO Tools for Small Businesses: A Beginner’s Guide

-

Business1 year ago

Business1 year agoThe Ultimate Guide to Amazon Advertising: Mastering Amazon Ads for Success

-

General7 months ago

General7 months agoThe Astronomer Coldplay Concert Scandal: A Viral Story That Shook the Internet

-

General9 months ago

General9 months agoThe Psychology of Likes: What Social Media Is Really Doing to Your Brain